This program allows you to upload 3rd party sales data for collections contracts. The transactions are uploaded from excel files using template provided by Iptor. The excel can have either Works ID or 3rd party item; the program will accept either. If its a 3rd party item then it will be validated with the rights exploit to retrieve the payment contract and the works ID for the item.

- In the menu, expand Publishing Modules > Rights & Permission > Other Incomes > Collection Contracts > Collection Contract and double-click 3rd Party Sales Upload. RYO453 Royalty External Sales Interface panel appears. All the existing upload batches are displayed. You can use function F10 (Open/Closed/All) to view only open or closed batches or all.

View available options

| Option |

Description |

| Detail |

Displays the batch data |

| Transfer |

Transfers the batch to AR for invoice generation. |

| Reverse |

This option allows you to reverse the sales royalty invoice for the selected posted batch (status=’P’). On taking this option the system will prompt for a batch number and will copy and negate the sales data from the original batch and create a new batch for reversal. On invoice reversal, any advance offset will be reversed. |

Create a upload batch

- Click Add to create a new upload batch.

View available fields

| Field |

Description |

| Customer |

This is the 3rd party customer from whom the sales transactions are coming from. |

| Batch |

A unique alpha numeric number must be entered to identify the batch for the above customer. The batch ID must be same as the excel sheetname holding the data to be uploaded. On upload the system will check for the excel sheet matching the Batch ID on the upload excel file. |

| Description |

Mandatory description for the upload batch. |

| Location |

This is the location of the excel file; its a non input field, it will default from the setup in XAM160 Document Exchange Maintenance. |

| Filename |

Name of the excel file to be be uploaded. The excel file must be created using the template provided by Iptor and it must reside in the location entered above. You will need to enter the full file name with the extension. |

| Company |

This is the company the customer belongs to and will default when customer account is entered. |

| Period |

This is a display only field, will be updated when the uploaded transactions have been transferred to royalty sales interface file. |

| Process no |

This is a display only field, will be updated when the uploaded transactions have been transferred to royalty sales interface file. |

| Total charge |

This is a display only field, it is the total amount to be charged to the 3rd party customer. It is calculated from the uploaded sales transactions after any currency conversion. |

| Batch status |

Batch header status (display only field).

- E = batch is created and not successfully uploaded yet

- V = batch has been successfully uploaded with no errors

- C = uploaded transactions have been transferred to royalty sales interface file

- P = posted

| Note |

A batch can be deleted even if invoiced as long as the invoice is rejected. |

|

- Enter the above information and click OK to save the batch. The status of the batch would change to ‘E‘ for entered.

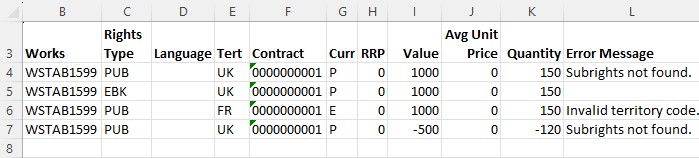

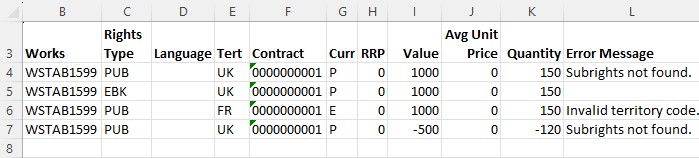

- Click function Upload to upload the excel data. The system will validate the data on upload. If there are no data errors the status will change to ‘V‘ for validated. If any errors are encountered on validation the excel would pop up highlighting the errors as shown below and the batch status would remain at ‘E‘.

- You can use function Excel to view the excel file.

- If there any errors, fix the data and upload again.

- When the data is successfully uploaded you will get the message ‘Data uploaded successfully’. Once the sales transactions are uploaded it can be transferred to AR for invoice generation using option Transfer. The batch header status would then change to ‘C‘ for completed.

| Note |

- On transfer the system will apply the step rates (as per the movement type) for the accumulated sales.

- If Override rate type is nominated on control file TMSRY/COL-ARIF, then this override rate type would be used to retrieve the applicable rate to convert the collection sales amounts. This is to allow sales reporting in foreign currency that maybe based on an agreed rate. A new exchange rate table can be setup to achieve this.

|