Set up tax registration with tax rules/rates by company

- Expand menu Base > Distribution > Masterfiles > Database Management > Other and double- click Work with VAT (VTW005).

- Enter the company code to add the tax setup to and click OK. Work with VAT Registration (VTW005A) panel appears, listing all the existing tax registrations.

- Click function Add to add a new tax registration.

| Field | Description |

| Tax registration | Name/code to identify different tax registrations for the company. |

| Loc Tax Cur/Tbl | If the base and the trade currency of the invoice is different to the local currency of the recipient and the tax amount is to be shown in the local currency on the invoice, then select/enter the local currency code on this field. This applies to sales to South Africa from UK with US trading currency. |

| Tax by | For packs you can nominate if the tax is to be calculated at parent or child level. |

| Item type ovr | This is the item classification code to override the rule. Example TMSDS/IC-TPXX can be set for an item to tax at parent level. |

- Enter the required information and click OK to save the tax registration.

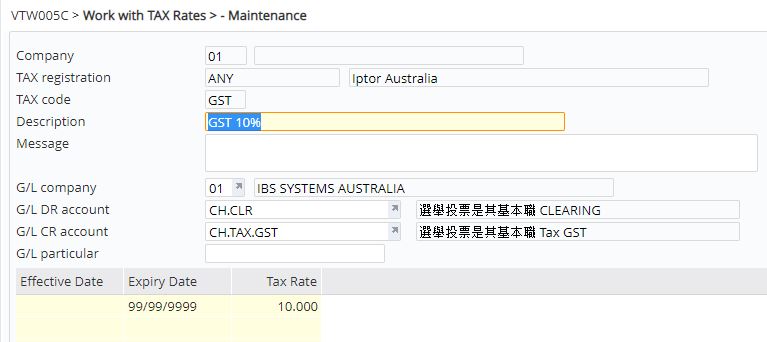

- Click Add to add the tax codes and the rates.

- Enter the above tax details and click OK. The text entered on the Message field will displayed on the invoice under the specified Tax code.

Note Negative tax rates can be entered for withholding tax.