Customers who are exempted from tax should have the tax exemption number nominated in the customer masterfile or have customer tax exemption database setup by this program. This exemption database is only applicable if the tax file number is not nominated in the customer masterfile. The exemptions database stores the exemption certificate, the effective dates and the states the exemption applies to.

Transactions for the exempted customer will be interfaced to Avalara with the tax exemption number. These customers with valid tax exemption numbers will be exempted from tax in Avalara system.

Customers flagged for exemptions and without a valid exemption certificate can have their orders pended in IP1 until a valid certification is provided.

View customer exemption

- Expand menu Other Modules > Other Regions > US Options > Other and double- click Customer Tax Exemption (BNW150). List of active exempted customers appears with their tax exemption number.

- Use option Display followed by function View URL to select and view the customer exemption certificate.

- Toggle function Show expired/Show all/Show active to view the related customer exemptions.

Add customer exemption

- Expand menu Other Modules > Other Regions > US Options > Other and double- click Customer Tax Exemption (BNW150). List of exempted customers appears with their tax exemption number.

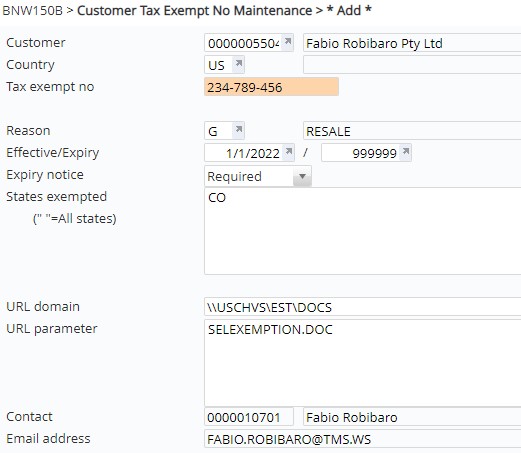

- To enter a new customer exemption click function Add. BNW150A Customer Tax Exemption appears in add mode.

- Enter the following information and click OK to save the new customer exemption.

| Fields | Description |

| Customer | IP1 customer code for the customer who is being exempted from US tax for the specified Country and State. |

| Country | Country where the tax exemption applies to. |

| Tax exempt no. | The Tax exemption number is mandatory for customer tax exemption. |

| Reason | The reason for tax exemptions, used to specify why a customer is being exempted from tax. The reasons are setup in system defined control file BNADS/AV-EX1. |

| Effective/Expiry date | Effective/Expiry date of the tax exemption. When the tax exemption expires the order can pend if pending controls are setup. When a tax exemption is being copied the effective date will default to expiry date plus one day. |

| Expiry notice | 1 = Provide notice to customer on the expiration of the tax exemption certificate.

2= If expiry notice is not required, change this flag to 2, i.e. no further action required. |

| States exempted | List the states that the tax exemption will apply to for the above country. Leave blank to apply the tax exemption to all states in the country. You can use the search function to select the states for the selected country. |

| URL domain/URL parameters | URL domain and file location to specify where the expiry certificate is located. |

| Contact/Email Address | This is the customers contact and their email address. The customer contact must be setup in Customer master and the contact type for this contact must be setup in Control file TMSDS/CM-CTSS for the respective Company for Dept/Role =Tax. |

Customer tax exemption numbers can be uploaded from an excel file as well. See Customer Tax Exemption No Upload.

| Note | When copying an existing exemption (i.e. about to expire) to a new one, the effective date on the new exemption will default to the expiry date of the existing exemption plus one day. |

Exemption pending

User defined pending code can be setup for customer exemptions, whereby an order can pend if customer exemption certification has expired. Control file TMSDS/PEND-DOC must have the user defined pending code for tax exemption and TMSDS/PEND-DO2 must include the plugin program (BNW150C) for this user defined pend code. Based on this setup, if a customer’s exemption has expired then the order will pend awaiting new certification. EOD program pending review will review and release orders as exemptions are updated.