Multiple stock obsolescence formulas, in matrix form, can be defined based on ‘item grouping’ levels that can be used for different purposes, for example management accounts or tax reporting. The matrix can be setup for each Item Level, over a selected period where the stock is to be amortized.

Also provided for are straight line write downs over the inventory values by publication (release) date or override date (for example for reprints where the publication date should not be altered).

Provision rates can vary with age of product. The system allows up to eight provision rates over the life of the inventory.

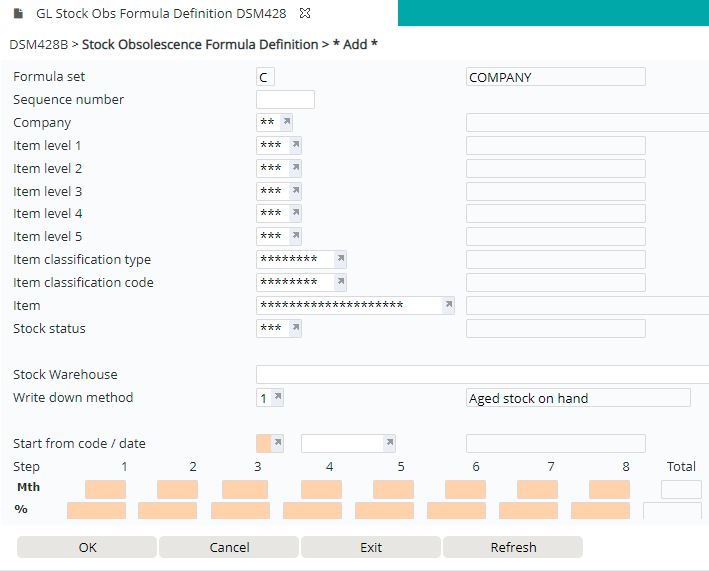

Add stock obsolescence formula

- In the menu expand, Base Modules > General Ledger > Other > Stock Obsolescence > Maintenance and then double-click GL Stock Obs Formula definition. DSM428A Stock Obsolescence Formula Definition panel appears.

- Select the Formula set. The formula set is used to identify the stock obsolescence calculation, for example, company or tax. Stock obsolescence G/L definition will be added to this formula set. On the next panel, available stock obsolescence formulas for the selected Formula set are displayed.

- Click function Add. DSM428A Stock Obsolescence Formula Definition panel appears in add mode.

| Field | Description | ||||||||||||||||||||||||||||||||||||||

| Sequence | The sequence number is given to identify the order of priority in instances where multiple definitions exist. The lower the number the higher the priority. | ||||||||||||||||||||||||||||||||||||||

| Company | The company code is included in the write down calculation formula. You can use ** to include all company codes. | ||||||||||||||||||||||||||||||||||||||

| Level 1-5 |

Hierarchy levels classify Titles into groups based on levels such as publishers, authors, subjects and so on. Indicate the Levels from 1 to 5 that are to be included in the stock obsolescence formula definition. To accept all use *** as a wildcard. |

||||||||||||||||||||||||||||||||||||||

| Classification type | Title classifications define different Title groupings which are user defined. For example, Markup Classes, Supplier Pack Quantities, Specialty Groups etc. Enter the Classification type to be used in the formula definition or use * to include all classification types. | ||||||||||||||||||||||||||||||||||||||

| Classification code | Title classification codes work in conjunction with classification types. They define a specific value within the classification type. For example, ‘Author’ is a classification type and therefore a classification code would be a specific author. To accept all use *** as a wildcard. | ||||||||||||||||||||||||||||||||||||||

| Item | A Title would be specified if for example it was an exception and the Start From Code would probably be O for Override. Reprints are an example of one type of exception. To accept all Titles use *** as a wildcard. | ||||||||||||||||||||||||||||||||||||||

| Stock status | This is the Stock status to use in this definition. Stock status control file TMSDS/IM-IBOR is linked with TMSDS/IWD-SS for selection of stock status codes and TMSDS/CC-ICG to select the Customer Group Code and company code to enable the user to create a specific obsolescence rule for a particular stock status and make provision as required. | ||||||||||||||||||||||||||||||||||||||

| Stock warehouse | Warehouse/s to be included in the formula definition. Warehouses like consignment, returns clearing etc. does not have to included for Stock obsolescence provision/write down. | ||||||||||||||||||||||||||||||||||||||

| Write down method |

Determines which write down method to be used in this definition. The screen will display different fields depending of the method selected. 1=Stock on Hand – displays months stepped and percentage to equal 100% 2=Moving Annual Total – displays Months till obsolete, Months to calculate average, and Months stock holding. |

||||||||||||||||||||||||||||||||||||||

| Start from code |

Enter the start period code which is to be used to determine the age of the products. Formula Start From codes are established in TMSDS/IWD-STRT. Note: This control file is partially user defined. Examples of codes are:

If using I = Immediate the result could be:

If using N=Never the result could be:

If using O=Override Date the result could be:

If using P=Publication Date the result could be:

If using R=Purchase receipt If the start date is R then only the last purchase receipt date will be used even if stock is physically received in advance. If using Y=Later of Pub/Rct: This caters for selecting the start date as the later of Publication or Last Receipt Date allowing obsolescence to begin from the Publication or Receipt Date even if stock is physically received in advance. |

||||||||||||||||||||||||||||||||||||||

| Start from date |

The start date is required only when using a Formula Start From code of O=Override. |

The following input fields are for Write down method =1 (Aged stock on hand):

| Field | Description |

| % rate |

The percentage rate at which amortisation will occur over the nominated period. For example, the total amortisation period could be 12 months duration. For the first 3 months the percentage rate at which amortisation will occur is 60%. For the next 3 months the rate is 30% and for the remaining 6 months the rate is 10%. Therefore, over 12 months the total rate of amortisation is 100%. |

| Total | This is the calculated total of the percentage rates for the stepped months. The total must equal to 100%. |

The following input fields are for Write down method = 2 (Sales based stock holding).

| Field | Description | ||

| Type of sale |

Select list of Types of sales in be included in the formula definition.

|

||

| Months till obsolescence | Number of months before stock obsolescence begins. | ||

| Months to calc average | Number of months for calculating sales average for the obsolescence period. | ||

| Months stock holding | Number of months for holding obsolescence stock. |

- Enter the above information and click OK to confirm.