The Cash/Journal entry option is used to enter and allocate payments and debtor adjustment journals to either the customer balances for balance brought forward accounts or to individual invoices for open item accounts. Payments and journals can be held on the system as unallocated or fully allocated and entries will be posted to any accounting month.

If no claim exists, a claim header can be generated when allocating payments. Claims allow for matching returns directly to a claim, by customer number and claim reference. There is an option to create a remainder as a journal of a claim with the remainder amount attached to the claim. When cash entry is by reference, an attempt is made to allocate against the original transaction group. If the negative amount cannot be allocated, a claim is generated and a reversed payment is allocated against the claim. TMSAR/ARE005-4 has the parameters for the claim defaults.

Payments can also be recorded via the Sales Order processing by the operator selecting a Transaction type of cash. This results in the display of a payment screen that requires details of the payment. If the payment is a cash payment it reflects on the account once the picking slip has been printed. If the payment is via credit card, the payment is reflected on the account once the invoice has been produced or the order is complete.

Payments are not allowed against documents that are in AR collection cycle.

The type of payment received is recorded via a Document type code. These codes are user defined. Each Document type has its own screen with specific information required regarding the payment, including whether a Payment Manger system is in place for handling online credit card payments.

Payments are entered by Batch. This batching process is used to group the transactions into Deposit Slip prints or daily payments received or even by collection clerk that processed the payment. Multiple batches can be consolidated into one Deposit Slip print if required. The Batch Number is system generated.

This process is subject to User Access Restrictions. Refer to User Access/Restrictions documentation for more information on this feature.

Record a cheque payment on an open item account

- In the menu, expand Base Modules > Distribution > Debtors & Claims > Accounts Receivable > Entry and then double-click Debtor Cash/Journal Entry. ARE005 Cash Entry payment selection panel appears.

- On the Payment function field, select CSH from the drop down list.

| Note |

Payment function will determine whether to increase/decrease debtor balance from the payment. Payment type will be defaulted by Payment function field. Control files for this function are TMSAR/BK-PFN, which defines the payment functions and TMSAR/BK-PFNL which defines the valid payment types for the payment functions. |

- Click OK. Cash entry header panel appears.

| Field | Description |

| Batch no | The cash/journal entry program has a system generated batch number. The batch number defaults to the current active batch for the location that the user belongs to. Default location by user is setup in TMSDS/POS-USRD.

The format of this batch number for cash payments is determined by the formats established on XACNA/AR-BTCH. Specific number ranges can be allocated per location to cater for Credit Controller separation if required. Users that can have automatic batch generation are setup in TMSAR/BAT-USR. This batch number is the Deposit Slip number and is used by the Automatic Banking Reconciliation process. TMSAR/BK-JNLI has the definitions and determines the batch requirements and banking journal interface parameters. |

| Period | The collections processing period will default from TMSAR/PERIOD. A payment can be processed into the next accounting period.

The system may display a message “Resolved collection period is outside valid range” as Accounts Receivable uses a collections period as well as a financial period. The financial period is established in TMSAR/PERIODA. When the End of Month (EOM) is processed, you can select to close both periods or only the financial period and run the collections period close at another time. This allows for the financial period and sales period to be closed at the same time, often prior to the end of a calendar month, but the cash collections can stay open till the calendar end of month to cater for most payments being received just prior to month end. |

| Document date | This field is only used when the cut-off date for debtors is different to that of sales. The date indicates to which calendar month the cash transaction relates. The system defaults to the current date. |

| Document type |

A Document Type or Payment Type is entered. The Payment Types are classified as Journals or Payments. The Payments are further classified into the type of payment being made, for example Cash, Cheques and Credit Cards and lastly whether the Cheque is actually a draft. Whether or not a Payment Type should print on a Deposit Slip is determined by flagging the Types as Payments or Journals. For example Telegraphic Transfers (TT’s) and Credit Card Payments processed electronically do not need to print on a Deposit Slip. A user can be restricted to processing only specific Payment Types and this security is established in TMSAR/BK-SEC. For Credit Card Payments, Payment Manager software can be called if this type of payment can be processed online. TMSAR/BK-PAYT has a Yes/No flag to validate the merchant details for Credit card payments. A Journal Document Type is selected for a Miscellaneous transaction. Document or Payment Types are established in TMSAR/BK-PAYT. |

| Entry option |

Entry option flag can be one of the following:

|

| Account | The Customer Account applicable to the payment or transaction is entered. Note that a closed account can still have cash allocations. |

| Reference |

Free format text can be entered which may be inquired on during cash entry. When processing remainders the reference is a Document Number as the remainder process creates new transactions for each Reference line entered. If the Reference number is meaningful it makes it easier to follow the history of a transaction. For example, if a customer is taking up a claim that has not yet been processed, use the customer’s claim reference. Multiple Remainder transactions can be created. In Instalment Contract Entry the Customer Reference defaults from sales order processing. |

| Company bank |

Indicate the bank to which the payment received is to be deposited. Bank codes can be set up for various Payment Types such as credit card payments (with bank codes for every type of credit card), foreign currency payments, cash with orders etc. This then allows for the printing of Bank Deposit Slips by bank code/payment type. A default Bank Code can be established in TMSAR/BK-DBKCD. Company Bank codes are established in TMSAR/BK-BKCD. The Bank Company and Currency will also be validated against this control file. |

| Receipt amount/Cur |

If the receipt amount is in a different currency to the company bank currency, then the receipt amount and the currency of the receipt amount can be entered. The system will convert it to the bank’s currency and display it in the Amount field. |

| Exchange rate |

This field is only displayed when the receipt currency differs from the trade currency; it’s the exchange rate for the receipt currency. |

| Exchange rate ovr. |

This field is only displayed when the receipt currency differs from the trade currency. It allows you to override the receipt exchange rate. The trade amount will then be calculated based on the overridden exchange rate. Note: If trade amount is overridden, the rate overridden will be cleared to signify that the overridden rate is no longer applicable |

| Amount |

The total payment amount in the currency of the company bank. If the receipt amount is in another currency then the system will convert it and display this automatically. When processing in the Remainders and Deduction screen, this is the amount of the Remainder Transaction. For example if a customer is taking up a claim that has not yet been processed, this Claim amount is entered here. Multiple Remainder transactions can be created and therefore multiple amounts can be entered. The sum of these amounts must clear the Remaining Amount displaying on the screen as the system does not allow you to file the Cash Entry if this balance is not zero. |

| Discount | Enter any settlement discount applicable. The total amount deducted from the debtor’s balance is the sum of the payment and discount amounts. The Discount is shown on the transaction details screen as a document type of DSC with a system generated reference number, and is allocated to the specified document number. |

| Note | Up to 4 lines text can be added on a payment header which will added as a diary text and can be viewed from the Debtor transaction inquiry (ARI015) with option 7=Text. |

| Function | Description |

| Inv search | Accesses DSI960 Document Search Selection to search for customer details via invoice number |

| Ref search | Accesses DSI962 Customer Order number inquiry to search for customer details by entering the customer reference number. |

- Enter the above cash entry header information, as necessary.

- Click OK to access the Cash entry detail panel.

| Field | Description |

| Tot amount | The total amount of the payment displays on the payment allocation screen. |

| Rem amount | The Remaining Amount displays on the payment allocation screen and initially defaults to the Total amount of the payment. As values are allocated to invoices or aged balances this amount reduces. It must be zero to be able to file the transaction. |

| Pay | Flag this field to indicate a payment is being made against the selected transaction. |

| Amount | On the payment allocation screen, outstanding transaction balances display in the Amount column. The payment amount only requires entry if it is under or over the balance amount. If the full outstanding balance of an invoice is being paid, press <ENTER> and the system defaults this amount to the invoice balance. If only part of the outstanding invoice balance is being paid, type in the amount to be offset against this invoice. If payment is being made against an aged balance, the same entry requirements apply as for paying an invoice. |

| Auto adjust |

In the payment allocation screen, this flag instructs the system to write off any remaining unallocated amounts and small outstanding balances either by default or when overridden during cash entry. If there is a discrepancy between the invoice balance and the amount being paid on the invoice, and this difference is a small rounding difference or error, the balance can be automatically adjusted by entering a Y in this field. An adjustment journal will be automatically generated for posting to the nominated GL account. Limits are set to control the value that can be adjusted down and the value that can be adjusted up. These limits are set in TMSAR/AADJ-LMT. For a short payment due to the customer taking up a Claim or Credit prior to it having been processed, the Remainder system can be used. For example, the balance is $10.50 and the payment is $10.00, a Y instructs the system to make an adjustment for 50 cents. N indicates that the system cannot adjust the amount. The payment must match the balance amount. Adjustments only apply to payments – they cannot be made for journals. |

| Functions | Description |

| Hide paid | Hide paid switches between showing transactions that have a zero balance meaning they have been fully paid (payment, credit, claim, journal) or only showing transactions that have a balance. When selected, the function displays as Show paid. |

| POS date | It switches between positioning to a Customer reference as the starting point of the transaction display or you can position to a starting Document number or you can position to a Due date. If no exact match is found for any one of these selections, the system will display the transaction with the closest match at the top of the list. This Position To toggle is handy when you want to find a specific Invoice quickly rather than paging up and down. By entering the invoice number in the field when it is a Document number selection, the document will display first on the list of transactions. |

| Sequence | Sequence switches between due date and original date and the column heading will change accordingly or you can sequence in document number order. The default sequence is established in TMSAR/ARE005-1. |

| Header | Accesses Cash entry screen in change mode to change the header details of account and pay. |

| Remittance | Remittance shows remainders and deductions entry. When the payment has been allocated to the appropriate invoices and a remaining balance still exists this Remainder function is used. The balance will be aged to the current period and is shown as an unallocated payment. Remainders or processing unallocated cash is covered in the section Payment with Unprocessed Claim Taken Up. |

| Aged | Access ARE005 Cash/Journal Entry by Age, which allows you to offset amount paid against applicable age. |

| Subset |

Access Cash Entry with the following selection criteria.

|

| Unalloc | Unalloc displays only the balances per Age or per Month. Payment is then recorded as unallocated against one or more months. Use this if the payment is to be unallocated on an account. |

- Select the invoice/s to be paid and flag the Pay field.

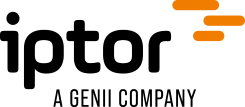

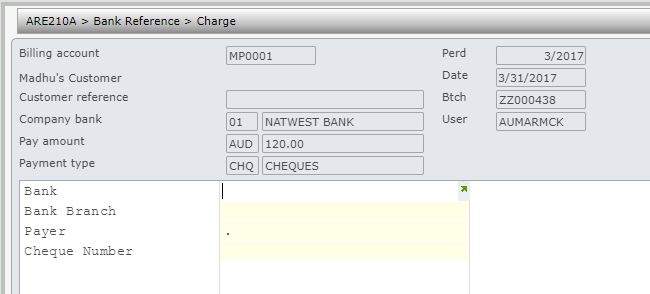

- Click OK. ARE210 Bank reference – Charge panel appears.

ARE210 Bank reference program accepts the bank reference details for the specified payment method. This program is also called by the payment entry program (DSE131) in Order Entry, Point of Sale and Claims Entry to accept the payment details for the payment method.

View the reference details required for the different payment methods| Payment method | Required reference details |

| CHQ |  |

| CC | |

| 3PV |

|

Function Card on File on ARE210 Bank Reference will display any existing credit cards that has been previously used for re-use.

- Enter the payment reference details and click OK to process the payment.

Cash entry functions

- Unallocate payment

- Document selection using customer reference

- Payment with an unprocessed claim taken up – remainder

- Payment by aged balance

- Auto allocation of multiple invoices

- Clearing house payment on an open item account

- Credit card payments

- Payment using incentive points

- Payment on a balance forward account

- Allocation of unallocated or remainder payments

- Foreign currency payments

- Dishonoured cheque processing

- Settlement discount on early payment

- Import payment data via excel

| Note | AR refunds via AP is allowed if payment type is setup in control file TMSAR/BK-PAYT with document/document sub type = 2/8 (Journal: refund via AP) and a creditor is linked to the billing account in TMSAR/AP-CN. The linked creditor should have the same company and currency. If a creditor is not linked to a billing account but defined by company and currency in TMSAR/BK-PAYT then the creditor should be miscellaneous. |

Other payment adjustments