This process uses the summary created by Royalty Movements monthly rebuild process and the Accrual account definitions and calculates accruals for the month. The journals are generated down to the payee level to determine which company to post to. These journals are posted to the General Ledger by Accruals post to GL program.

Unpaid invoice royalty is treated as pended accrual and posted to pended royalty accrual account and on full payment of invoice, it will transfer from the pended accrual account to royalty accrual account. RP/PR (pended royalty accrual account set) must be setup in account set definition control file TMSRY/RY-ACDEF.

Once this calculation has been done, the Accrual report can be printed. If the details on the report are not satisfactory, determine what changes need to be made to either the Movement definitions, Contract details like Movement types or percentage rates. If a contract should have been included and has not been created, this contract can be created and the cycle started again.

The Accrual Calculation process posts accruals in the currency of the contract. If the contract currency is not equal to the base currency, then it is converted using the ruling rate for the GL account based on the GL posting period. The accrual calculation process to GL picks up the exchange code from the contract rather than the royalty base currency code control file. If the contract currency is not equal to the base currency, then calculate the base GL posting figure converting from the contract figure using the ruling rate for the GL account, based on the GL posting period. The base amount is calculated from the contract figure and loaded into the base. Foreign amounts for the GL transaction file are loaded at the payee’s currency.

If the results of the calculation are not due to any set up issues, a manual adjustment may be needed. For example in the case of adjusting the quantity sold.

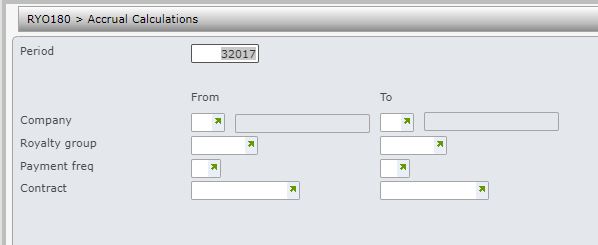

- In the menu, expand Publishing Modules > Rights & Permission > Period Processing and Others > Monthly Royalty Run and double-click Royalty Accrual Calc. RYO180 Accrual Calculations selection panel appears.

| Field | Description |

| Period | The Accrual calculation must be run for a selected Royalty period. The period defaults to current processing period, but can be overridden. |

| Company | This is the Royalty contract company. Contracts belonging to a range of companies can be selected for Accruals calculations. User access must be setup for the company/companies in control file TMSRY/UA-ACC and TMSRY/UA-ACT. |

| Royalty group | When a contract is established, the Royalty group is nominated. Contracts belonging to a range of royalty groups can be selected for Accruals calculations. Movements monthly rebuild, Accruals post to GL & AP interface can be run for a range of Royalty groups. |

| Payment frequency | When a contract is established, the Payment frequency is nominated. Contracts for a range of payment frequencies can be selected for Accruals calculations. Movements monthly rebuild, Accruals post to GL & AP interface can be run for a range of Payment frequencies. Royalty Statements can print for a specific Payment frequency. |

| Contract | A range of contracts can be selected for processing. |

- Enter the above information as required and click OK.