A template is a blueprint that holds common data so you do not have to re-key the same information over and over again.

The Contract template program enables you to set up a template for contracts where parameters can be pre-defined. For example there are three different Contract Types and each one of these could have a template. A contract template can be set up for common contracts or can be created per movement type or per movement type combinations. When creating a contract, a template can be loaded into the new Contract, defaulting the standard conditions thereby reducing the number of entries to be keyed in.

Currency can be entered for a contract templates. The currency is only maintainable until payees have been defined for the contract. The contract currency is maintainable again if payees are deleted.

Create a contract template

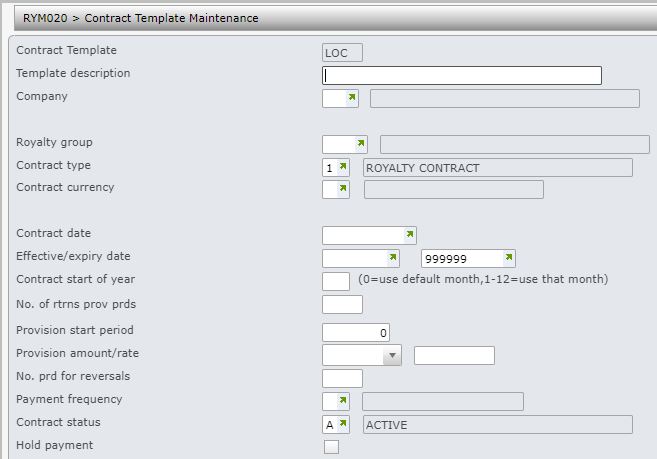

- In the menu, expand Publishing Modules > Rights & Permissions > Maintenance and double-click Royalty Contract Template. RYM020 Royalty Contract Template Maintenance panel appears.

- Enter an ID for the new contract template and select default option Contract.

- Click Add. RYM020 Contract Template Maintenance panel appears in add mode.

| Field | Description |

| Contract template | Contract template ID as entered on the previous panel. |

| Template description | A brief description of the template. This is a mandatory field. |

| Company | The operating company under which the contract template or the contract will be created. |

| Royalty group | Royalty group is a user defined optional field that can be used to group contracts for specific conditions. It can be used to process priority contracts. Contracts belonging to the same royalty group can be selected for processing in the statement print and interface to Accounts Payable. User access to royalties can be set by Royalty group. |

| Contract type | Contract type identifies the type of contract being created. Royalties would be generated depending on the contract type. |

| Contract currency |

This is the currency the contract operates in and is mandatory. The statement to the IP owner would be presented in this currency. All accruals would be in this currency and all sales transactions would be converted to this currency before being stored. Payments to the creditors would be converted to their currency before the payments are made. |

| Contract date | This is the date the contract is established. Contract date is for information purposes only. |

| Effective date |

The Effective date is important and used to determine which transactions are to be included in the Royalty calculations. Any sales and other applicable transactions prior to this effective date are not included in the Royalty calculations. For example if a publisher has bought the rights from another publisher, liability for royalty payments only starts from a specific date. This date is important for Returns Provisions processing. For example if it is decided to take up a Returns Provision in the first and second Royalty Periods, the system needs to be able to determine what the first Period would be. For a template, this field is usually left as 00/00/00 and when the Contract is created using a template, the actual date is entered. |

| Expiry date |

The Contract Expiry Date is used to determine when royalties are no longer to be calculated. Any sales and other applicable transactions after this date are not included in Royalty calculations. Royalties are therefore no longer paid. In a template, this date is usually left as 00/00/00 and when a Contract is created using a template, the actual expiry date is entered. |

| Contract start of year |

A Royalty cycle can start in any Financial Accounting Period. The Financial Year and Royalty cycle do not have to have the same starting and ending periods. The valid choices are: 0=use default month or 1-12=use this month. If the Royalty cycle is the same as the Financial Year, enter 0. A default Start of year can be set-up in TMSRY/SOY. If this field is left blank or a 0 is entered, the default is used. For example if the Start of year value is 1 (January) and the Royalties are paid every six months (Payment Frequency Code H) then Royalties are calculated for payment at the end of June and December. |

| No. of rtrns prov prds |

Determines up to what period to take up Returns Provision. This could be for the life of the book or typically it is for the first 6 months of sales which could be the first Royalty Period. If it is for the first two Royalty Periods, enter 2. Once the Provision has been taken up it must be decided how long to keep it before paying the author. This is indicated in the No. of period to hold/No. prd for reversal field. The Provision calculation is based on the total transaction quantity combined with the Provision Rate. The Effective Contract Date is used to determine the start of the Royalty Periods for this Contract. |

| Provision start period |

This is the period you want provisions to start. |

| Provision amount/rate |

If the returns provision is to be calculated as a percentage of the total royalty earned then select Rate. If it is flat amount then select Amount. Enter the percentage or the amount and if returns provision is not being used then enter zero. |

| No. prd for reversals |

This determines how long to keep the Royalty money before paying it to the Author. If the provision is to be kept for two Royalty periods, the entry would be 2. This means the provision taken up in the first Royalty period is reversed in the third Royalty period. |

| Payment frequency | Payment frequency represents the frequency in which the royalty statements would be generated. The standard frequencies are Monthly, Quarterly, Half Yearly, Yearly. This is system defined and mandatory. |

| Contract status | This determines the status of the contract. The default is A=Active and may be overridden. When the status is Active, royalties would be processed and paid out. When the contract is on hold, royalty will be calculated, but it would not be paid out i.e. the balances would be carried forward. In Closed status royalties will not be processed. A contract cannot be closed if balances exist.. |

| Hold payment | This flag can be used to carry forward all royalty payments instead of paying it out via Accounts Payable interface. |

- Enter the above information and click Page down.

| Field | Description |

| Orig wrk dlv date | The original work delivery date is for informational purposes. |

| Contract term/optional | This is the term of the contract; number of years the contract is valid for. Contract term is used in the calculation of the expected reversion date. The optional term is the extension of the original term. This would be the case when the publisher wishes to extend the term because the product is doing well and the publisher sees a future in managing the product further. |

| Reporting/Termination window | The reporting window is for information only. It specifies the number of months before the statement has to be sent to the IP owner/payee. Termination window is the number of months the IP owner of the contract has to be advised prior to the termination of contract. |

| Original producer | The original producer or the editor; for informational purposes. |

| Assign to successors |

This flag indicates if a successor to the IP owner is to be assigned. |

| Consent required | This flag indicates if the IP owner should be consulted for permissions required for extracts of the products. |

| Free units 1st run owner/Agent | Represents the number of free copies the owner/agent is to receive on completion of the first production run and is for informational purposes only. |

| Free units 2nd run owner/Agent | Represents the number of free units the owner/agent is to receive on completion of the second production run and is for informational purposes only. |

| Return artwork/original work | Determines whether to return the artwork/original work to the author, defaults to Y=Yes and can be overridden to No, to be kept by the publisher. This is for informational purposes only. |

| Imprint | Imprint identifies the imprint of a specific title e.g. bibliographic information about a title, trade name etc. |

| Right | |

| Term | |

| Copyright notice | Copyright text message for the published title. |

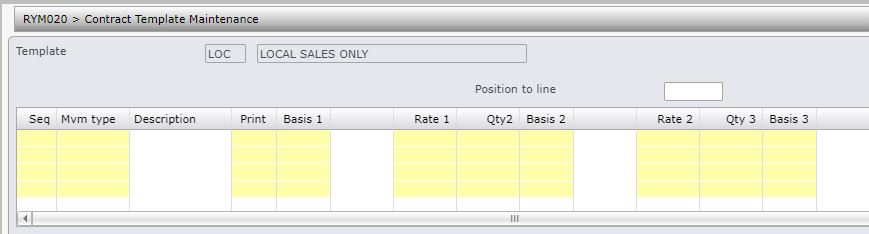

- Enter the above information and click OK. Movement details panel appears to define the movements for the template.

| Field | Description | ||

| Sequence |

Multiple Movement types may apply and their order of preference is determined through the use of the Sequence field. When the Royalty calculation is performed it reviews each transaction detail and matches it to the Movement types in sequence to determine into which bucket the sales value must be posted. If a transaction does not meet the criteria as defined for the first Movement type, the next Movement type is referred to, and so on. If the sequence of Movement types is not set up correctly, a higher or lower sales value could be calculated resulting is a higher or lower royalty value being paid out. If there are overlapping conditions in the Movement type definitions, the first bucket to meet the criteria is selected. The sequence also defines the order in which the Movement type details print on the Royalties Statement. |

||

| Type |

This field identifies the Movement type applicable. When determining the Movement types, consider the sequence of the details on the Royalties Statement. Multiple Movement types may apply and their order of preference is determined through the use of the Sequence field. If a transaction does not meet the criteria as defined for the first Movement type, the next Movement type is referred to, and so on. The sequence of Movement types would probably be high discounts and remainder sales and other special conditions and then normal sales. If there is no overlap in conditions the sequence is not as critical. Royalties are probably not paid on certain Movement types where no profit is made, for example when stock is being offloaded as a Remainder sale. If Sales and Returns are to be shown separately, two Movement types must be created. |

||

| Description | Description of the selected Movement type. | ||

| The Print flag per Movement type determines whether to print or omit particular movement details on the Royalty statement. A Title’s Royalty statement displays all stock movements, royalty calculations and totals for a particular period. The system offers the facility to select which Movement type details are to be printed on the statement. If it is decided to omit transaction details, a Movement type can be nominated to absorb the resulting stock movement discrepancy. | |||

| Basis per step |

The Price Basis code is required to define the unit price on which the royalties are to be calculated. A Basis per Rise (number of copies) as well as a basis per Movement type can be entered. The Net Value is the RRP net of discount. The Average Selling Price is similar to the RRP except the total value is divided by the total quantity to determine the Selling Price. The United States uses code 4 Prevailing rate. For export sales they use the current local Prevailing rate and nominate a Percentage of the local prevailing rate. For example: 90%, as the export rate. Code 5 Amount per Unit is a flat amount. Code 6 Recommended Retail Prices less Tax is used by New Zealand as the GST is not to be included in the price.

|

||

| Rates per step | This determines the royalty rate to be calculated for each step. In the example of 10% royalties for the first 5000 copies sold and 12% for the next 5000 copies sold, the 10% is entered in the Step 1 Rate field and the 12% is entered in the Step 2 Rate field. | ||

| Stepped royalty quantity |

The Stepped or Rising Royalties function allows for different Royalty Rates and Price bases to come into effect, based on predefined transaction quantities. In order to calculate royalties the system uses the transaction quantity, combined with a given unit price and royalty rate. If it is a flat rate, not dependent on the number of copies sold, these rises do not have to be completed For example 10% royalties on the first 5000 copies sold and then 12% on the next 5000 copies sold. The first 5000 is entered as the quantity for step 1 and the second 5000 is entered as the quantity for step 2, etc. The various steps could be print runs and the quantities the number of copies printed in the print run. |

- Enter the above information as required and click OK.