Introduction

Iptor IP1 system caters for various tax structures of different countries. As well as catering for simple tax system like the 10% goods and services tax in Australia, it also handles more complex tax structures of countries like India with multiple levels of tax which may differ for different regions. Multiple taxes can be set up to be charged at central government, state or local levels along with taxes levied on services (service tax).

Overrides can be setup for customers and items whereby customers are charged tax at parent level for packs. Base, trading and local currency can be printed on the invoice.

Setup process

Business rules setup

The following business rules have to be setup to handle Sales tax process. Business rules for Sales tax process must be setup with support from Iptor IP1 consultants. It is critical to understand the setting of control files and how it works. Control files must be setup correctly for the system to operate as intended. Any changes to the control files setup should be addressed cautiously and in consultation with Iptor IP1 consultants.

| Note |

This document does not cover customised setup tasks of specific companies. Deviations from this setup should be covered by setup tasks written by individual companies. |

View the business rule

| Control file |

Setup |

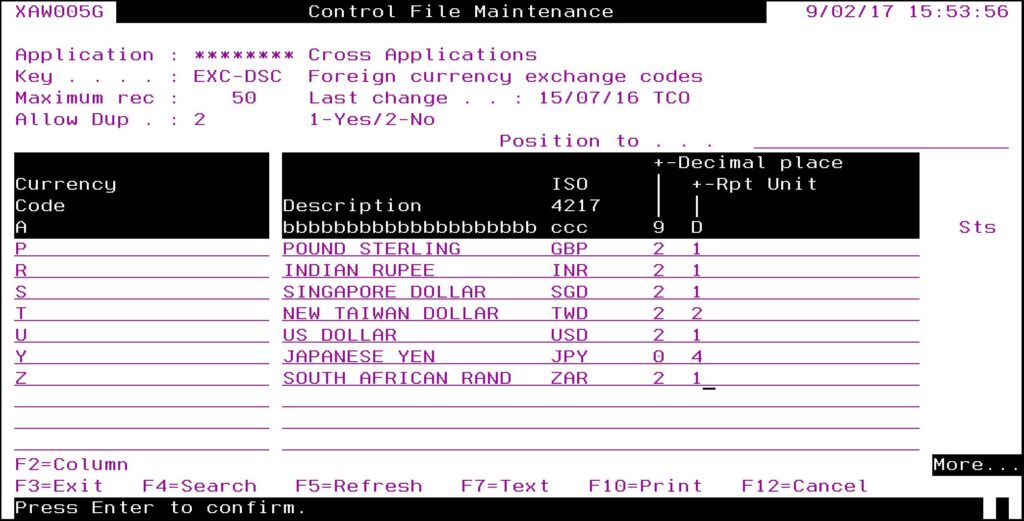

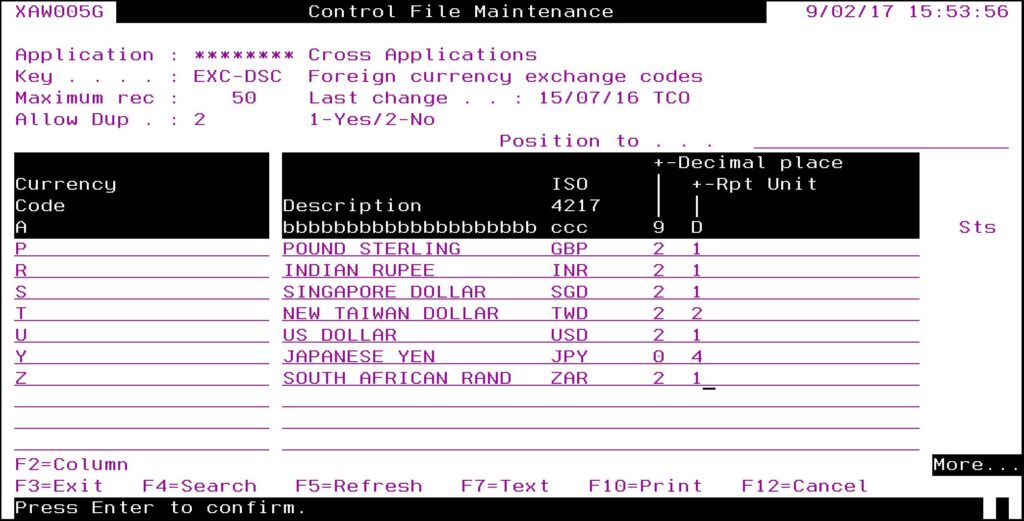

| ********/EXC-DSC Foreign currency exchange codes |

Add all the currency codes required to handle various tax rates for all the countries, including South African rand.

|

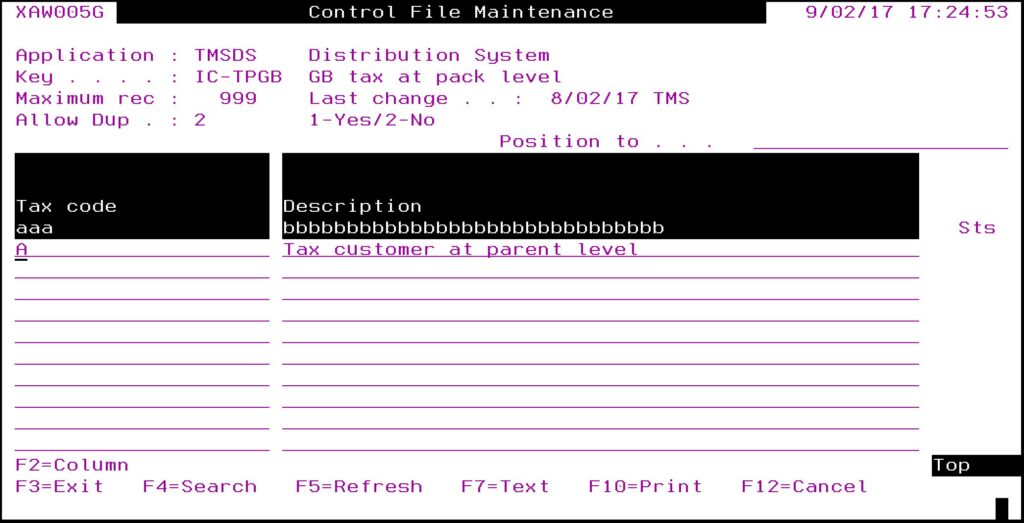

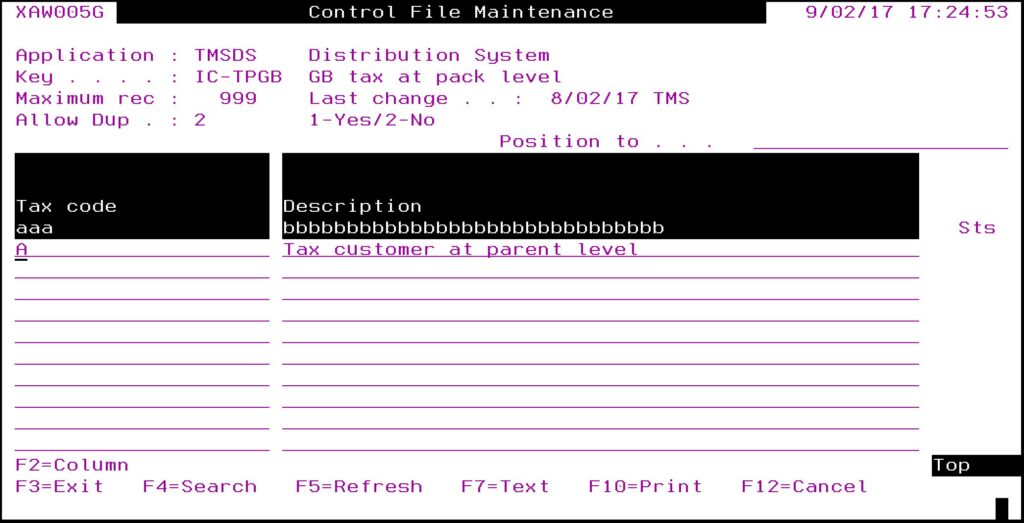

| TMSDS/IC-TPXX |

For each company XX, where items may be taxed at pack level create this control file and add it to TMSDS/IC-TYPES.

|

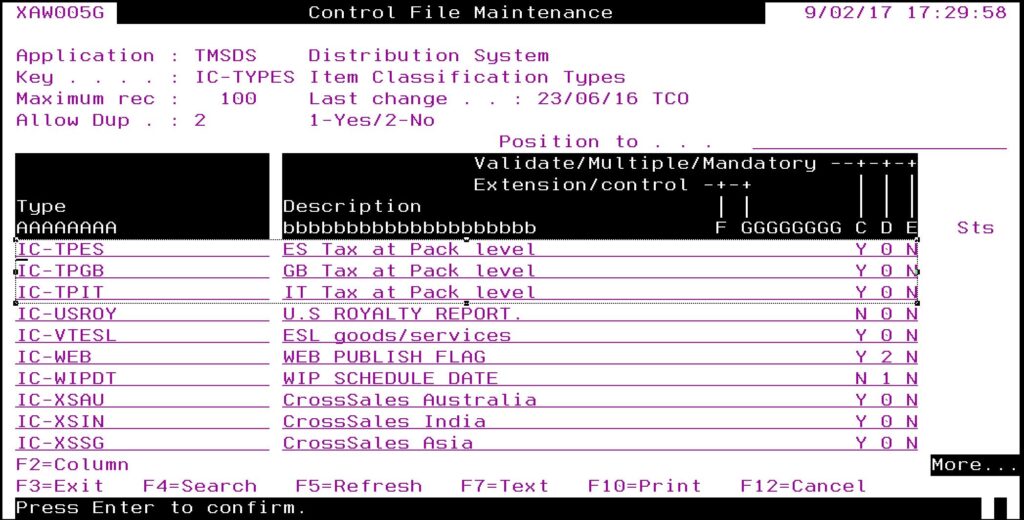

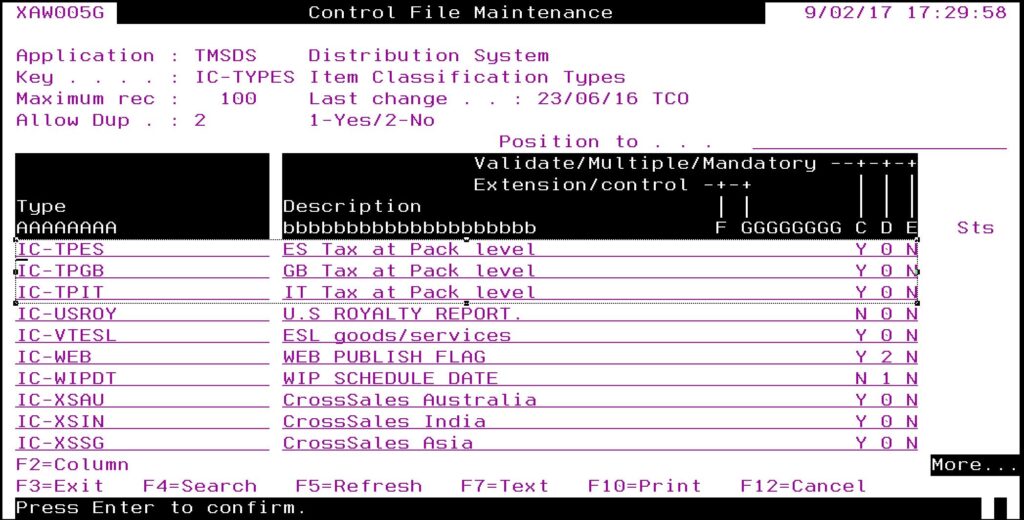

| TMSDS/IC-TYPES Item Classification Types |

Add above control file(TMSDS/IC-TPXX) to TMSDS/IC-TYPES.

|

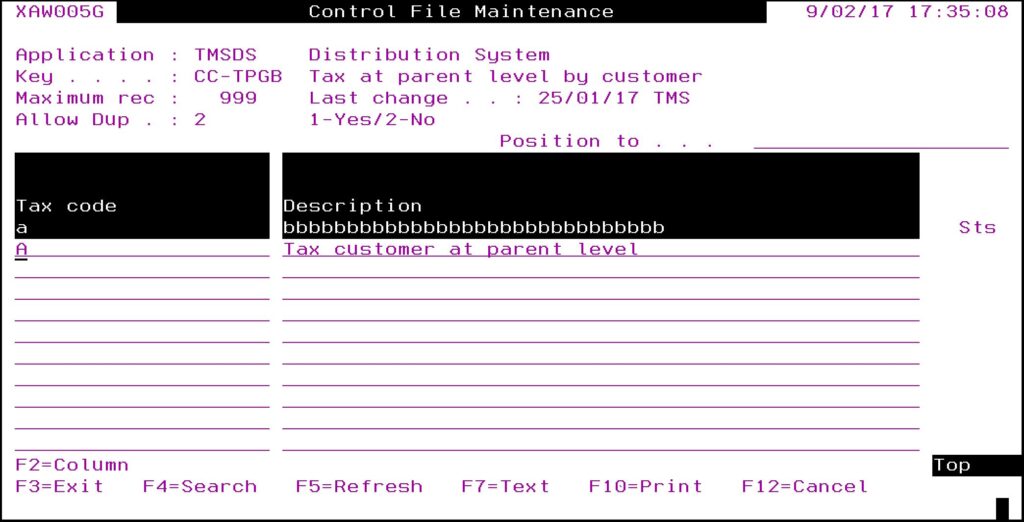

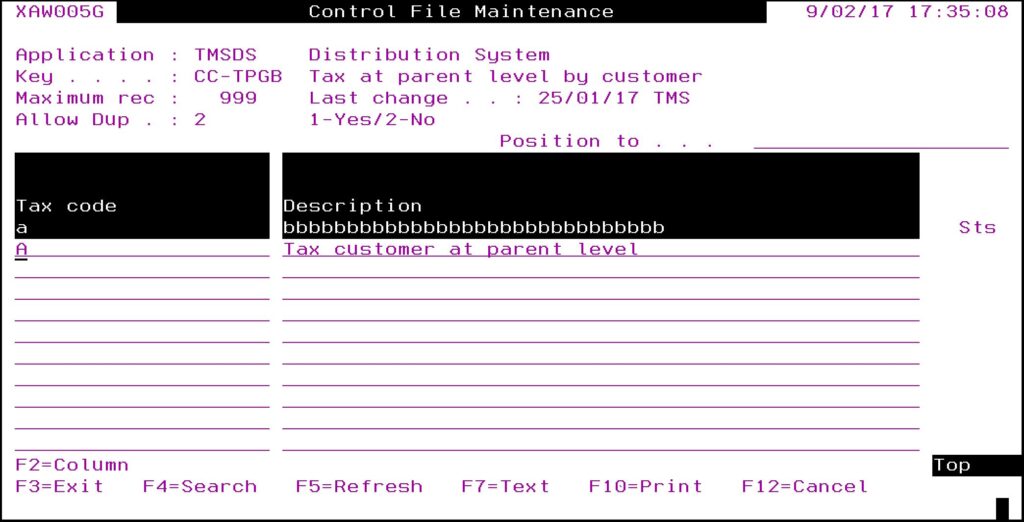

| TMSDS/CC-TPXX |

For each company XX, where item is to be taxed at pack level for a customer create this control file and add it to TMSDS/CC-TYPES.

|

| TMSDS/CC-TYPES Customer Classification Types |

Add above control file(TMSDS/CC-TPXX) to TMSDS/CC-TYPES.

|

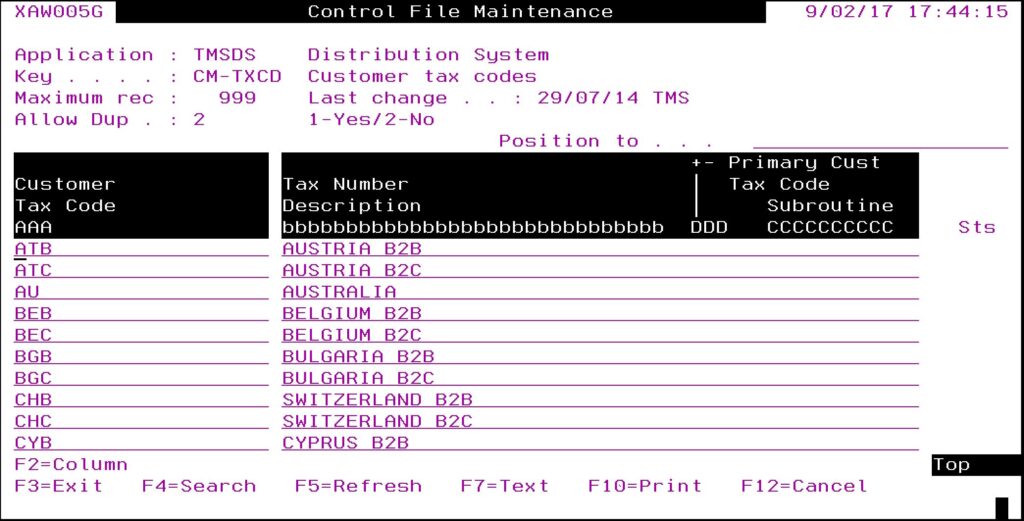

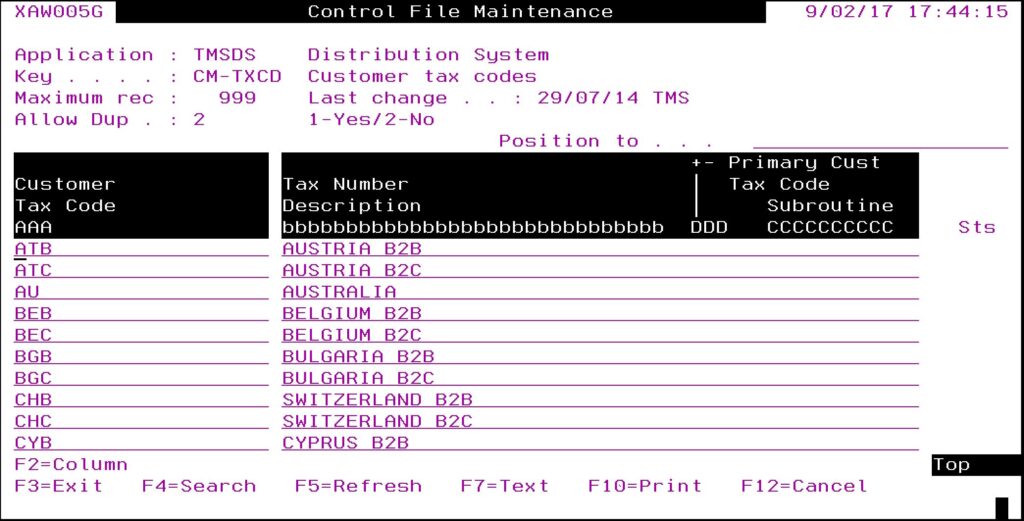

| TMSDS/CM-TXCD Customer tax codes |

Setup all customer tax codes.

|

| TMSDS/IM-TXCD Item Tax Codes and Rates |

Setup all item tax codes.

|

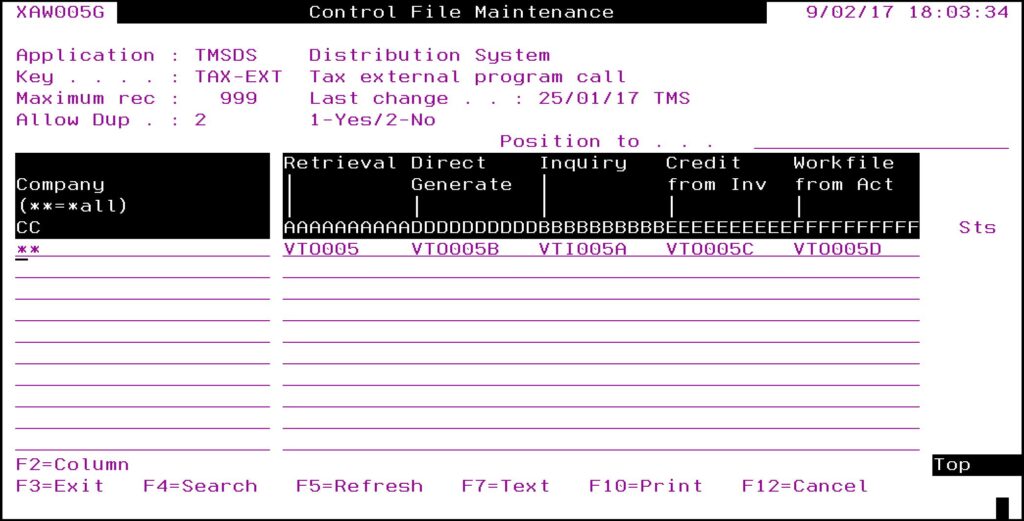

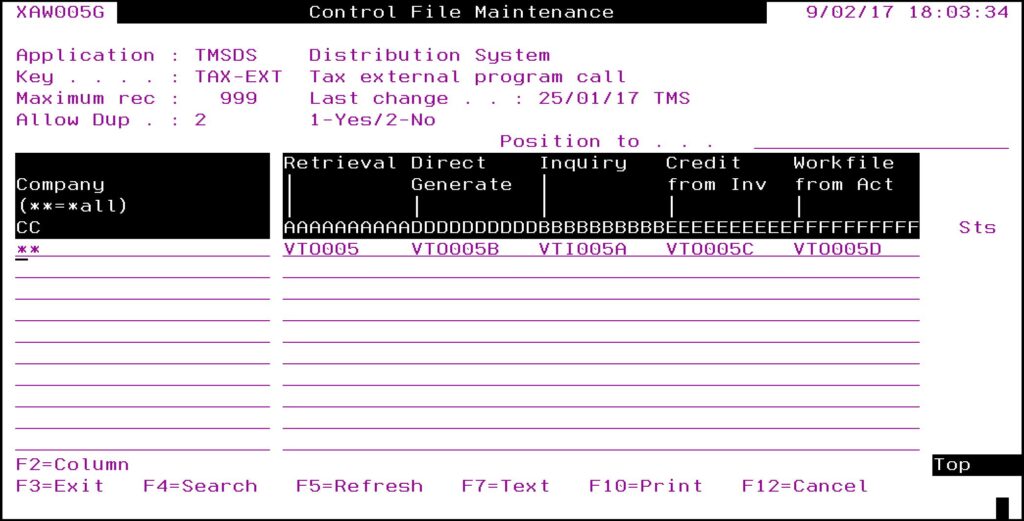

| TMSDS/TAX-EXT Tax external program call |

Add last 2 columns ‘Credit from Inv’ & ‘Workfile from Act’.

|

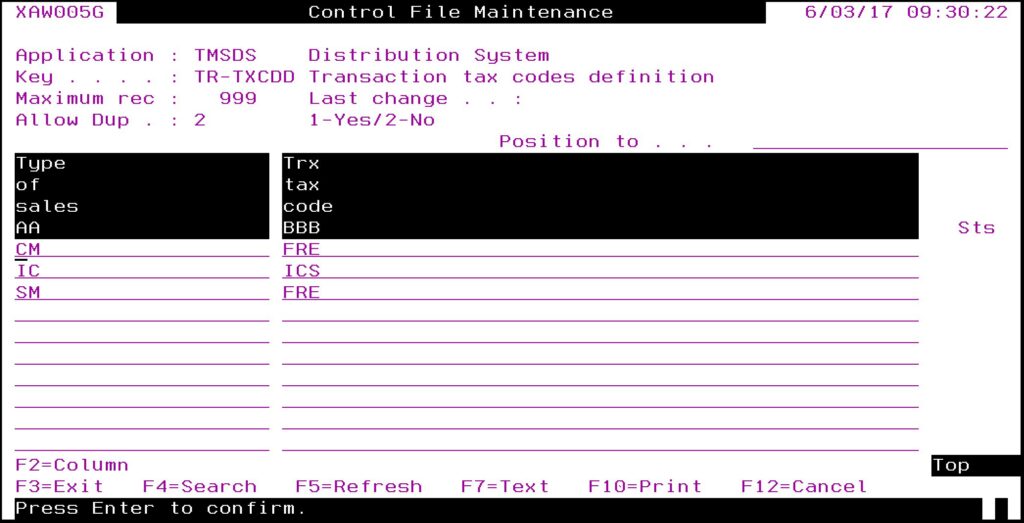

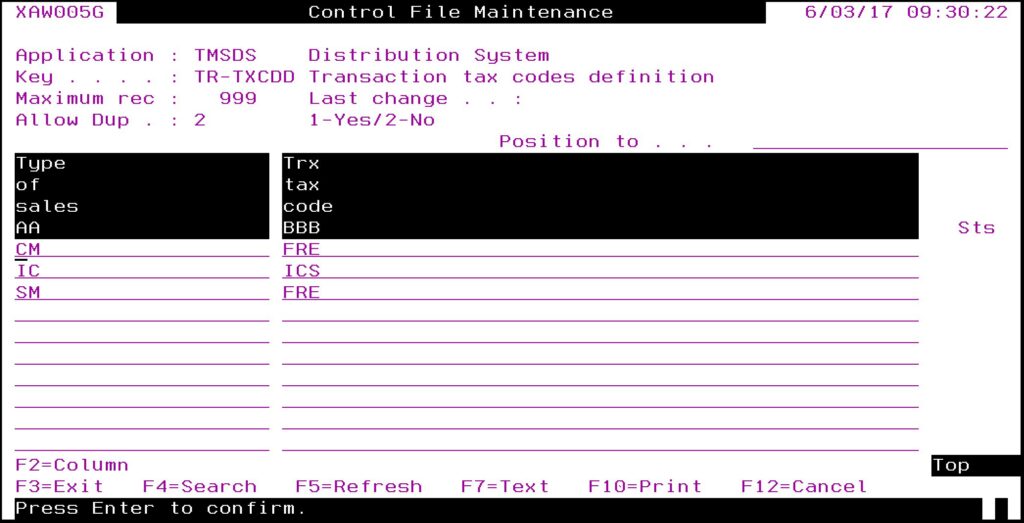

| TMSDS/TR-TXCDD Transaction tax codes definition |

Define transaction tax codes for complimentary, sample and inter-company sales.

|

Other setup

| Tasks |

Instructions |

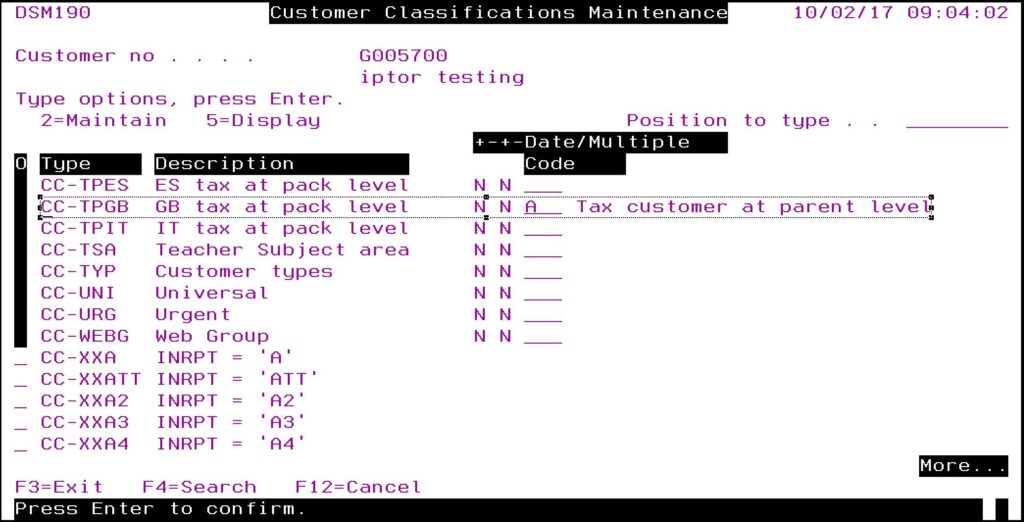

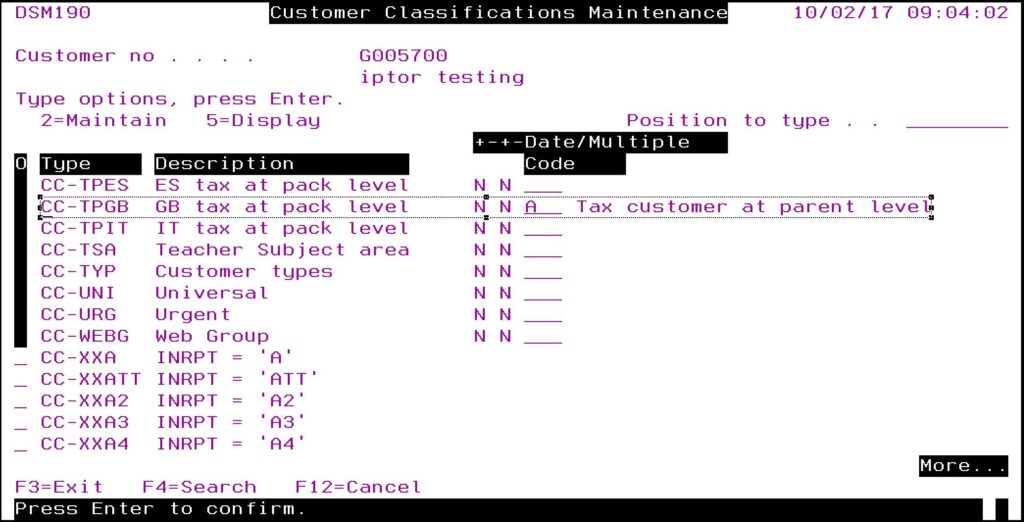

| Link classifications to customer where customer is to be charged tax at pack (parent) level. |

- Expand menu Base > Distribution > Masterfiles > Database Management > Database Management > Customer Masterfiles > Customer Masterfiles and double click CM Masterfile Maintenance (DSM005).

- Enter the customer code and click option Customer Classification Maintenance.

- Click Page down to get to customer classification CC-TPXX, (XX = company) and select Tax code = ‘A’ (Tax customer at parent level).

|

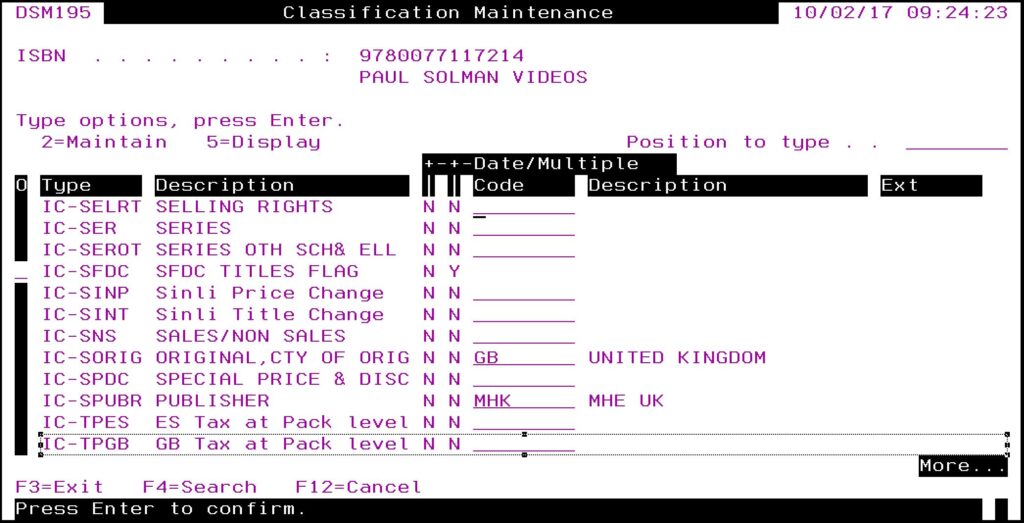

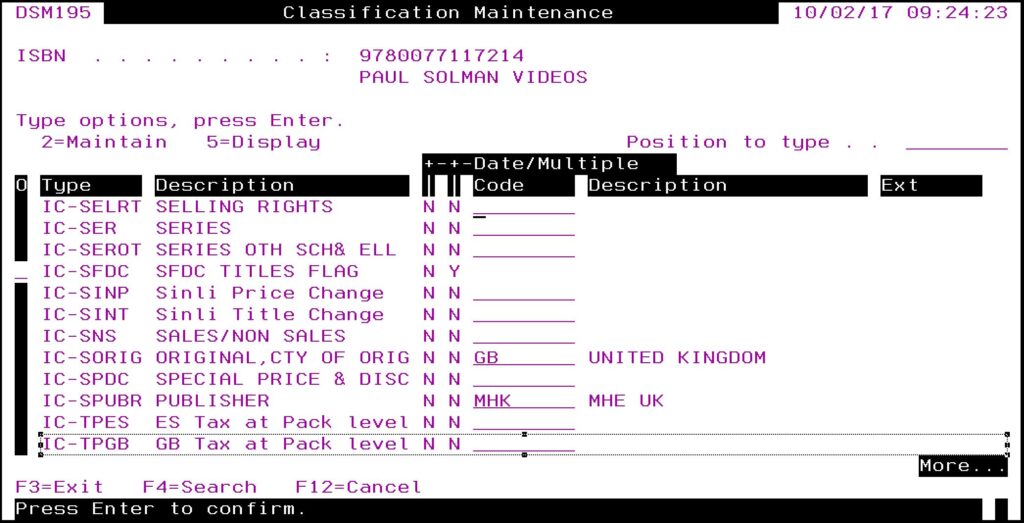

| Link classifications to items where customer is to be charged tax at pack (parent) level. |

- Expand menu Base > Distribution > Masterfiles > Database Management > Database Management > Item Masterfiles > Item Masterfiles and double click IM Masterfile Maintenance (DSM015).

- Enter the item code and click option Title Classification Maintenance.

- Click Page down to get to item classification IC-TPXX, (XX = company) and select Tax code = ‘A’ (Tax customer at parent level).

|

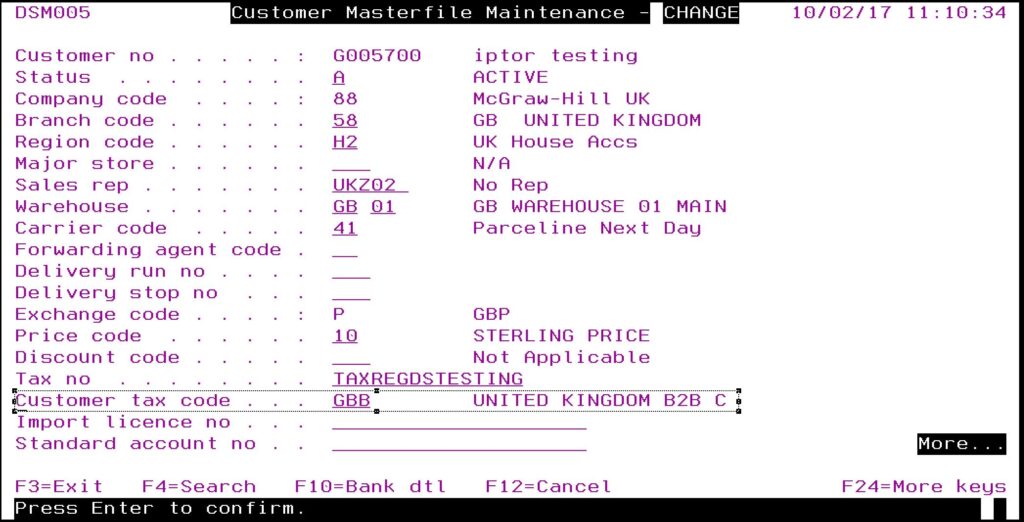

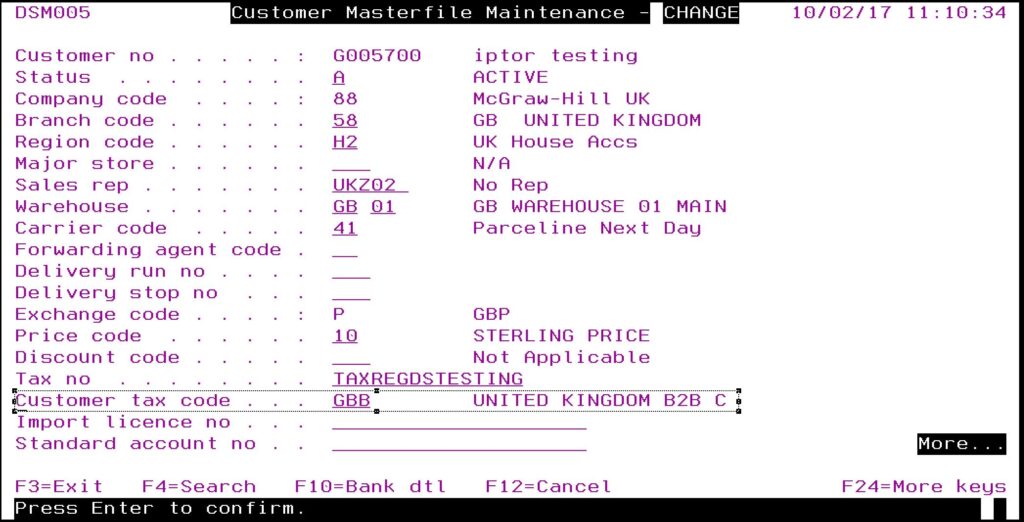

| Ensure the customer tax code in Customer master is correct |

- Expand menu Base > Distribution > Masterfiles > Database Management > Database Management > Item Masterfiles > Item Masterfiles and double click CM Masterfile Maintenance (DSM005).

- Enter the Customer code and click OK.

- Click Page down and look for Customer tax code.

|

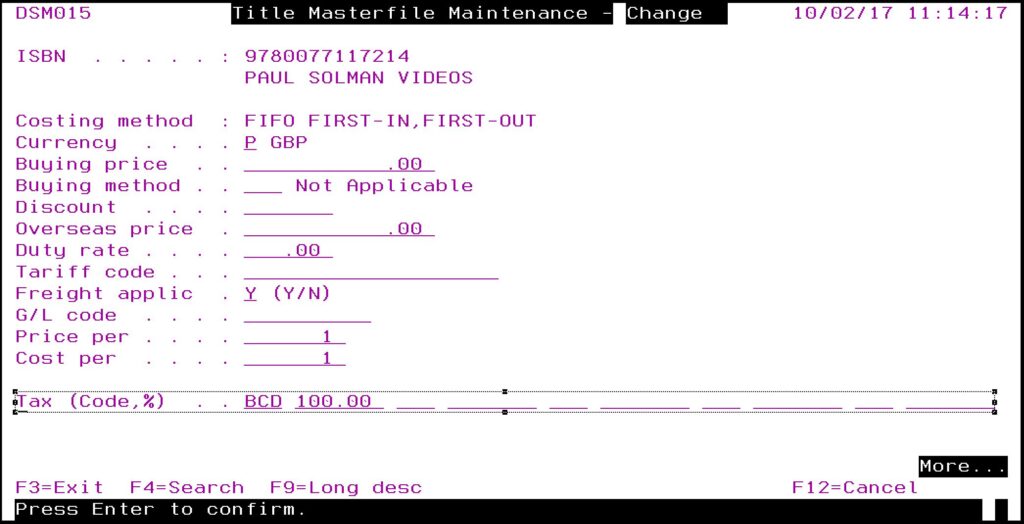

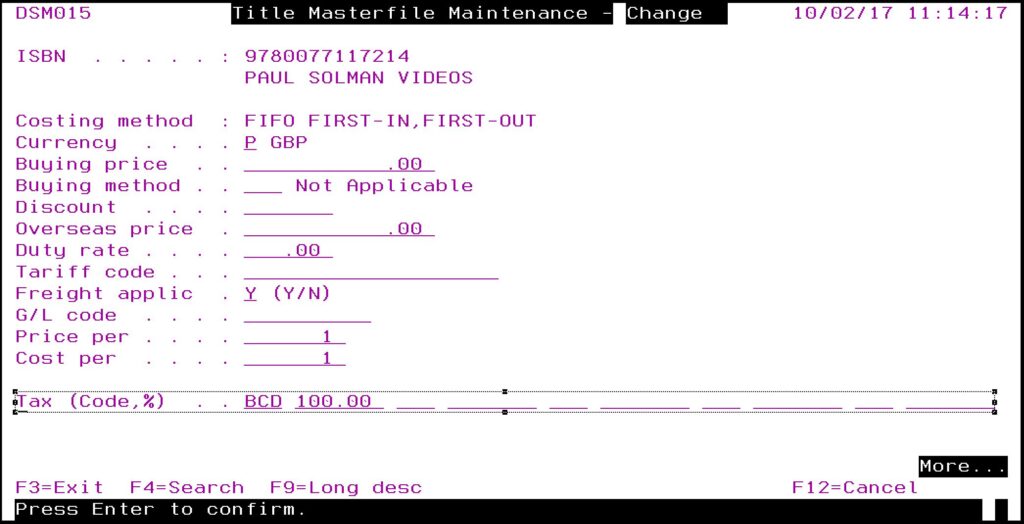

| Ensure the item tax code in Item master is correct |

- Expand menu Base > Distribution > Masterfiles > Database Management > Database Management > Item Masterfiles > Item Masterfiles and double click IM Masterfile Maintenance (DSM015).

- Enter the Item code and click OK.

- Click Page down and look for Tax code.

|

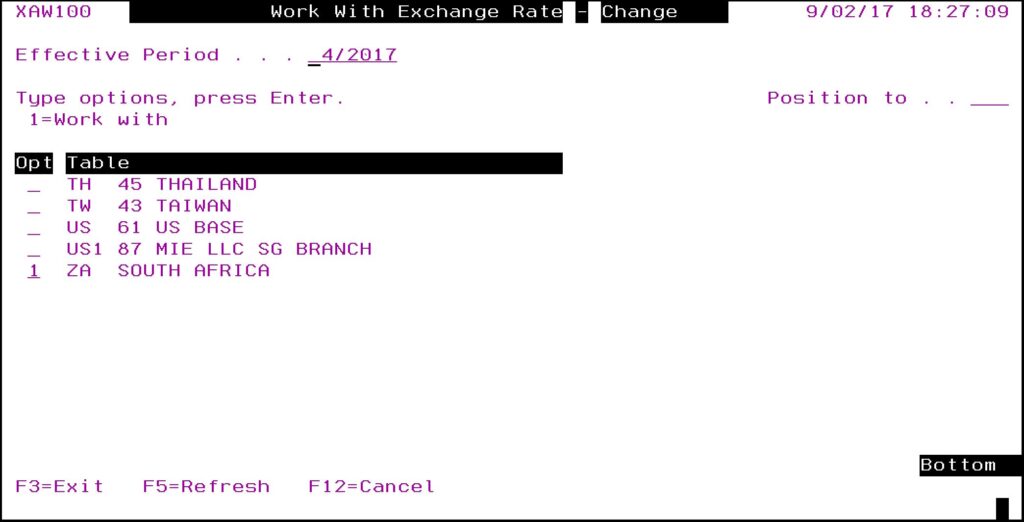

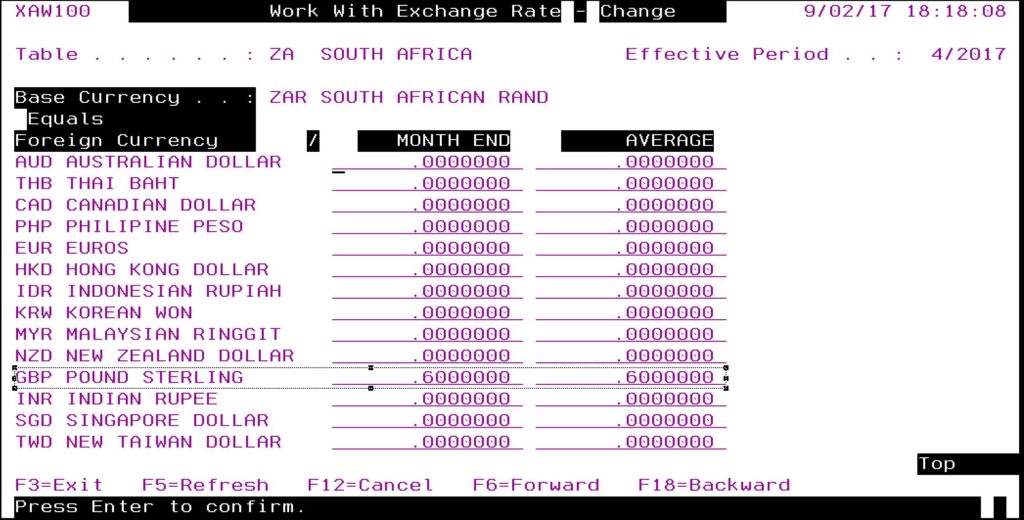

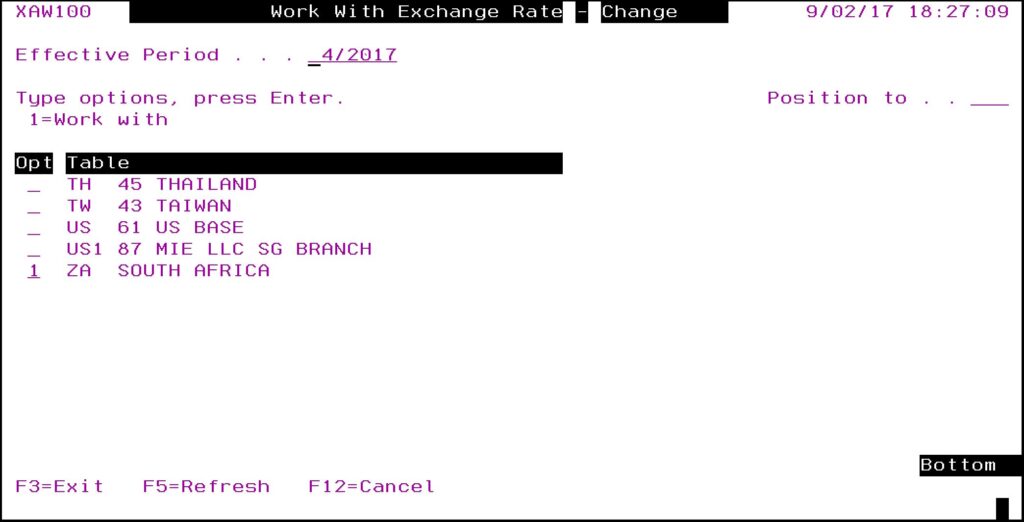

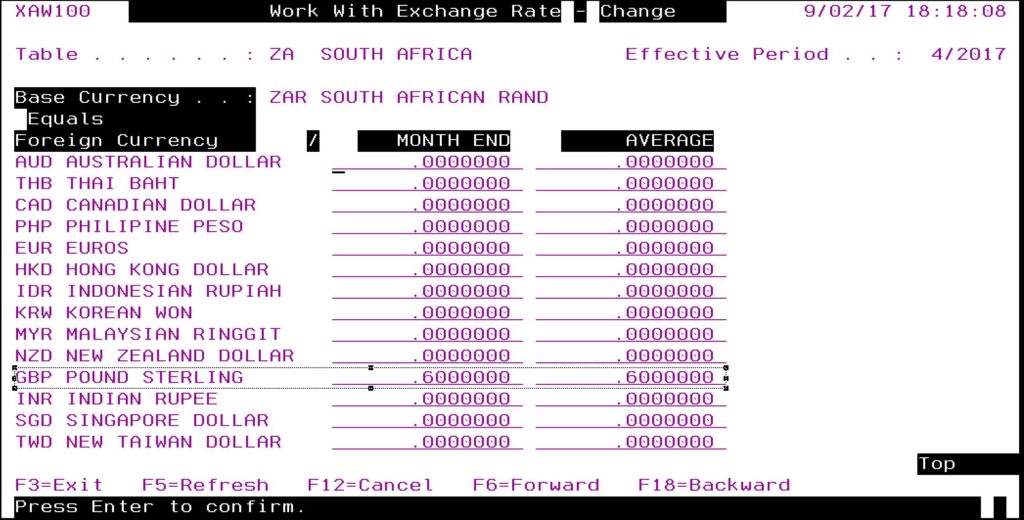

Work with exchange rates

| Task |

Instructions |

| Update the exchange rates database. |

- Expand menu Base > Distribution > Masterfiles > Database Management > Database Management > Exchange Rate Management > Exchange Rates Masterfiles and double click Work with Exchange Rate (XAW100).

- Select ‘ZA’ South Africa and click option Work with.

- Update ‘GBP’ with current exchange rate.

- Click Page down.

- Update ‘USD’ with current exchange rate.

- Click OK to save.

|

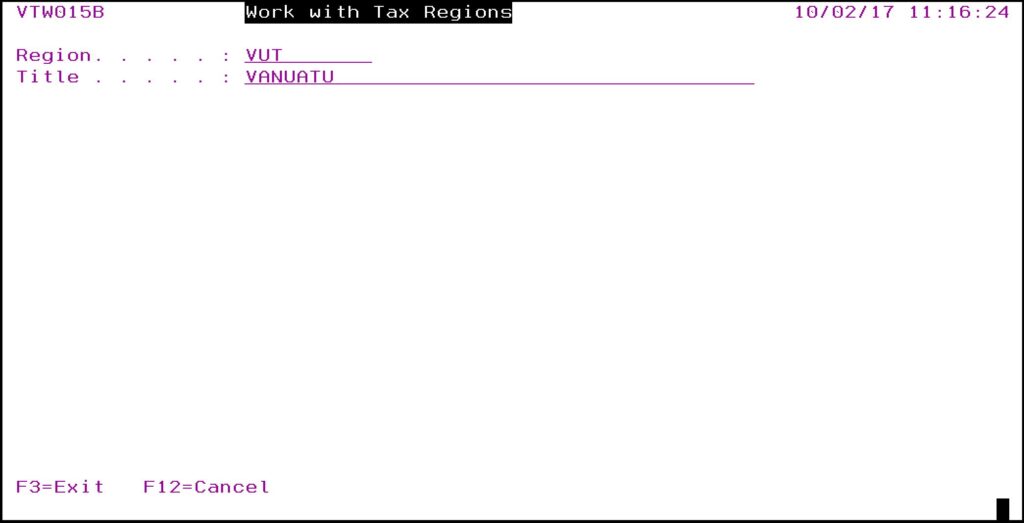

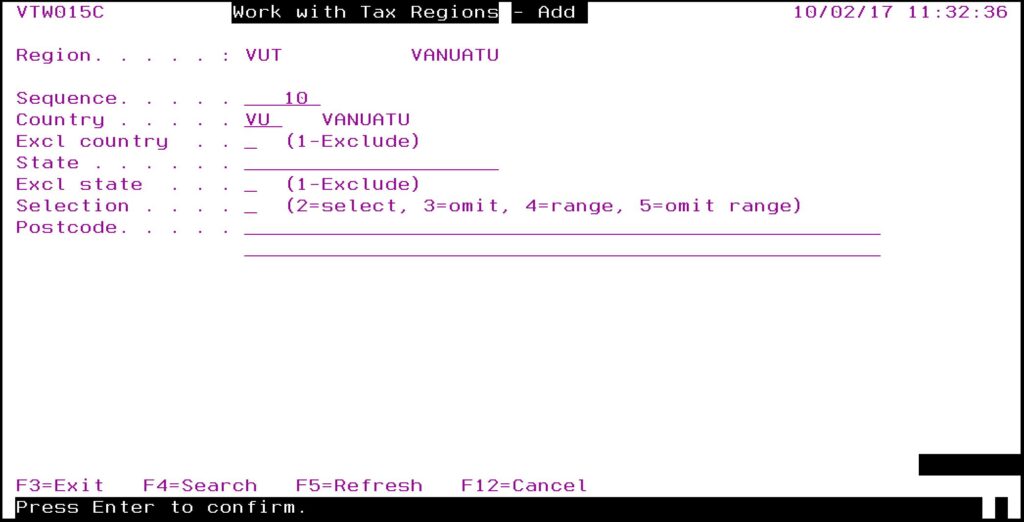

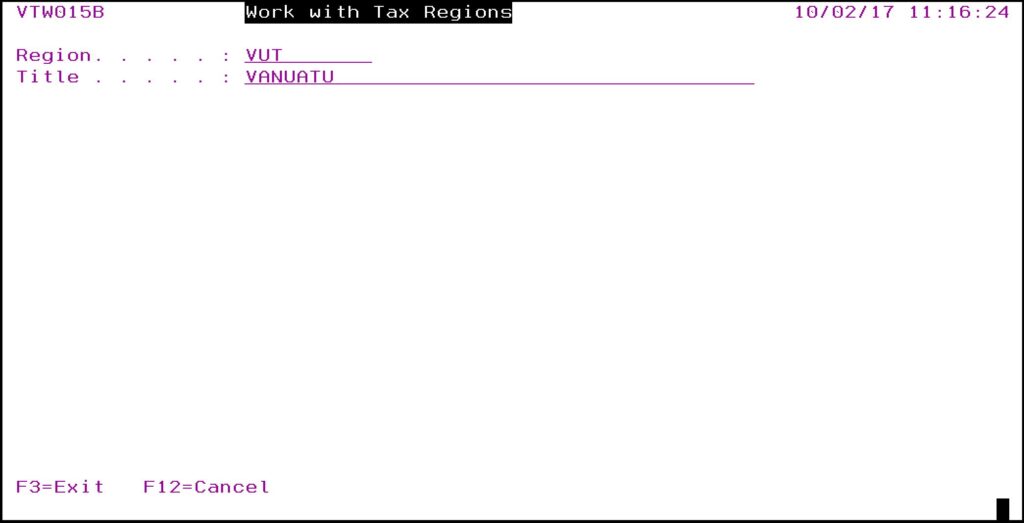

Work with VAT regions

| Task |

Instructions |

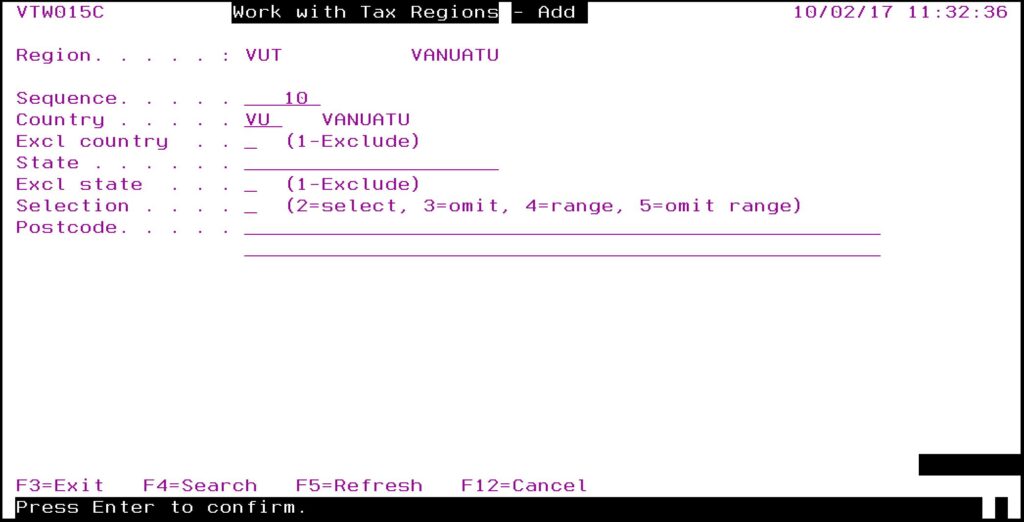

| Setup tax regions. |

- Expand menu Base > Distribution > Masterfiles > Database Management > Other and double- click Work with VAT Region (VTW015). A list of existing tax regions appears.

- Click function Add to enter the applicable tax region.

- Enter the VAT region and Title (description).

- Click OK to save the region.

- Select the newly created region and click function Add to add country, state & postcode as applicable.

| Note |

You can set up Regions by country or by country, state and/or postcode. Australia has only 1 tax rule therefore the setup is simple, only by country. |

|

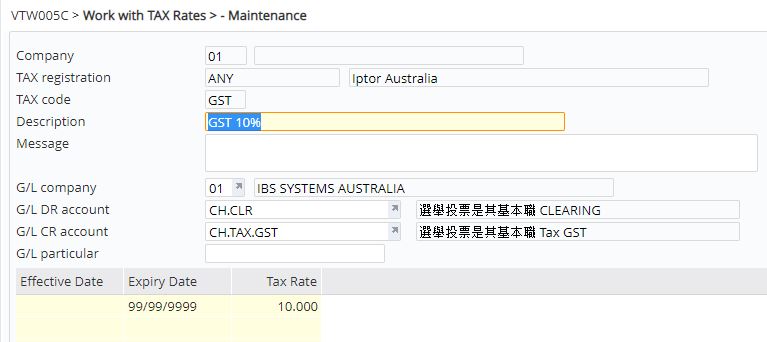

Work with VAT

| Task |

Instructions |

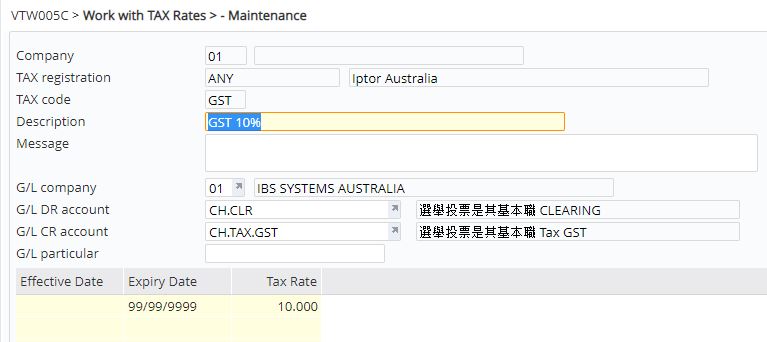

| Setup all the applicable rules & rates for each company. |

- Expand menu Base > Distribution > Masterfiles > Database Management > Other and double- click Work with VAT (VTW005).

- Enter the company code to add the tax setup to.

- Click function Add to add a new tax registration.

- Enter the Registration name, Description, Address and Phone number.

- If the base and the trade currency of the invoice is different to the local currency of the recipient and the tax amount is to be shown in the local currency on the invoice, then select/enter the local currency code on the field Loc Tax Cur/Tbl. This applies to sales to South Africa from UK with US trading currency.

- For packs you can nominate if the tax is to be calculated at parent or child level in the Tax by field.

- For Item type override, enter the item classification code to override the rule. Example TMSDS/IC-TPXX can be set for an item to tax at parent level.

- Click OK to save the tax registration. Once the tax registration is created, you can add the tax codes and the rates.

- Click function Add to add the Tax code, Tax rates, GL accounts and the Effective & Expiry dates.

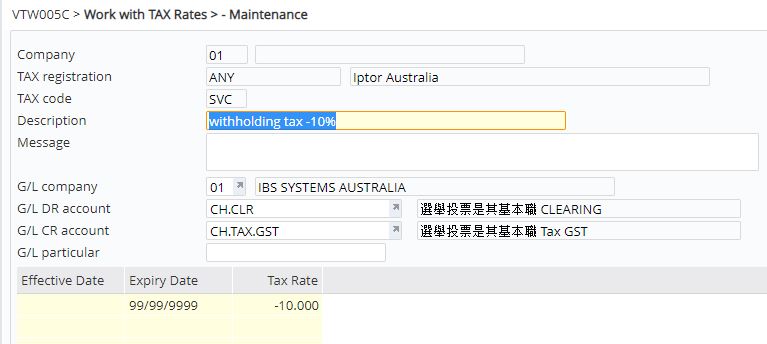

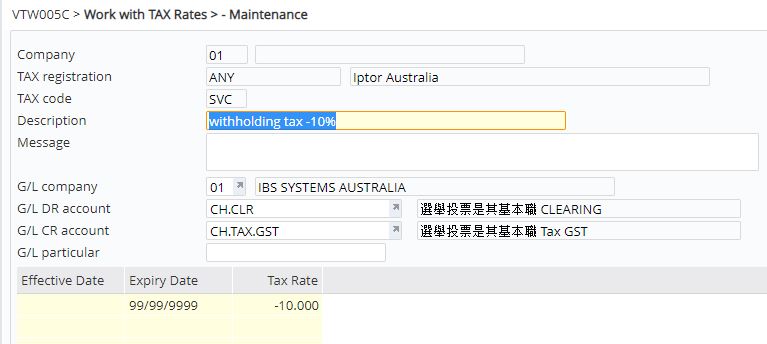

- Enter the above tax details and click OK. The text entered on the Message field will displayed on the invoice under the specified Tax code. Tax codes with negative tax rate indicates withholding tax as shown in the panel below.

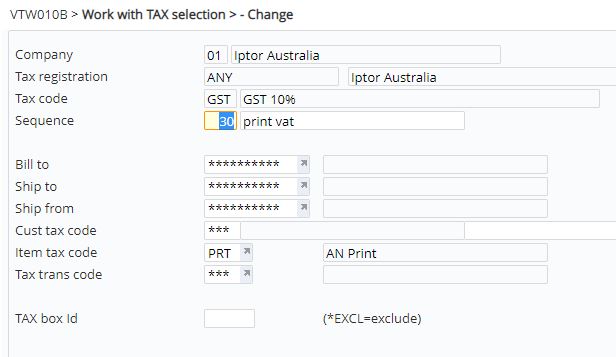

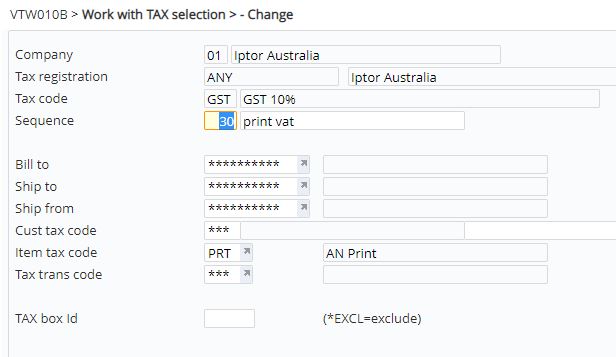

- Click function Add to add the lowest level of tax rules and apply to customer and/or item tax codes.

- Click OK to save the rules.

|

| IMPORTANT |

If the setup is incorrect, please do NOT delete it, as there may be transactions already against it. Instead expire the setup and create a new one. |

Tax inquiries

| |

- Expand menu Other Options > General Inquiries > Customer Inquires and double- click Trans by Customer Inquiry (DSI130).

- Enter the Customer code add click OK. List of transactions/documents for the customer appears.

- Select the document and click option Orig document.

- Select the item to view the tax for and click option Tax. All the charged tax for the selected item from the document appears. Note: Negative tax amount indicates applicable withholding tax.

- To view the details of the charged tax, select the line and click option Detail.

|

Tax reporting

The following sales tax reports are available.

- Sales tax report

- Detailed sales tax report

- Item sales tax report

- Giveaway tax report

The following reports are specific to Europe.

- VAT detail report

- VAT summary report

- VAT intrastat report

- VAT intrastat detail report

- VAT ESL quarterly list

- ESL detail report